Solving urgent needs and seizing market opportunities

Easy to solve for you

Import payment pressure

Saving financial expenses

Improve trade bargaining power

Rapid withdrawal of funds

Easier order taking

1.出口商希望获得即期付款,但进口商及进口商银行希望远期付款并获得资金融通。 2.进口方所在国家和地区的资金成本高于我国。

1.出口商流动资金有限,依靠快速的资金周转开展业务。 2.出口商在发货后、收款前遇到临时资金周转困难。

出口商流动资金紧缺,而国外进口商不同意预付货款,但同意开立信用证。

Improving negotiation status

Goods are guaranteed

Reduce capital pressure

1.贸易结算项下,出口商接受货到付款的条件,但对收款速度有较高要求。 2.进口商与出口商有良好合作关系且对其充分信任,愿意接受预付货款的条件。 3.进口商流动资金充足,当前的主要目标是控制财务费用而不是取得融资便利。

1.进出口双方希望对彼此的行为进行一定约定以提升贸易的可信度。 2.进口商处于卖方市场,且出口商坚持使用信用证方式进行结算。 3.进出口双方流动资金不充裕,有使用贸易融资的打算。

出口商了解进口商的资信状况,并且有足够的资金用于备货和发运。

Accelerate capital turnover

Improving cash flow

Avoiding buyer credit risk

Saving financial expenses

客户货物周转量大,行情走俏,急需资金支持,但客户除货物以外的其他担保品有限,无法从银行获得足够的授信额度满足其融资需求。

在备货阶段有融资需求的卖方。

希望规避买方信用风险、国家风险,并已投保信用保险;流动资金有限,需改善资金状况。

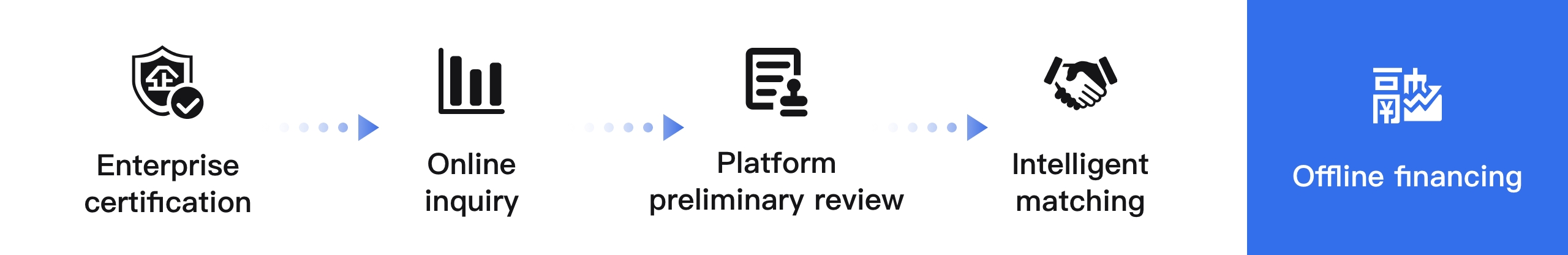

Enterprises can make online inquiries through Paypaytone trade finance services.

The platform intelligently matches funding institutions, and the financing party selects the best to obtain quotes to complete the financing.

Enterprise information review, recommend personalized trade finance olutions, meet the constantly changing business and technological needs of users, and provide excellent user experience for small and medium-sized enterprises.

Collaborate with leading global trade finance technology solution providers to provide users with high-quality services.

Accelerate capital turnover

Improve bargaining power

Simplify financing procedures

Seize market opportunities

Saving financial expenses

Avoiding various risks

Paypaytone

Paypaytone

T-CloudFair

T-CloudFair

SaaS

SaaS

Kiosk

Kiosk

TradetoB

TradetoB

PaypayData DaaS

PaypayData DaaS

Sell2where

Sell2where

Gtrade365

Gtrade365

T-CloudFair

T-CloudFair

SaaS

SaaS

Kiosk

Kiosk

Trade to B

Trade to B

PaypayData

PaypayData

Global store opening

Global store opening